Business Imperatives for Semiconductor Manufacturing in Volatile Times

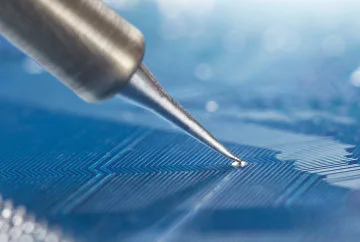

Next-generation electronics, machines, medical devices, and beyond – all need new and enhanced semiconductors.

ABI Research estimates around eight million consumer vehicles that will be shipped in 2025 will feature SAE Level 3 and 4 technologies, where drivers will still be necessary but can shift safety-critical functions entirely to the vehicle under certain conditions, and SAE Level 5 technology, where no driver will be required at all.

Over

70% of security surveillance cameras will ship with on-device real-time monitoring and analytics functions within the camera, up from less than 5% in 2018. This transformational landscape enables and powers 5G, AI, Edge Computing, and IoT onto chips. Continued focus on structural growth drivers in the emerging technology space will aid the semiconductor companies to create a more resilient and reliable future for the world.

Click to zoom in

Manufacturing Execution

The ever-increasing complex, geographically dispersed, and constantly changing global marketplace necessitates semiconductor manufacturers to continuously innovate to serve the demand for unstinting quality with higher efficiency and lower cost. To respond effectively to rapid and frequently volatile change, enhanced visibility and greater collaboration across supply chain networks are paramount.

With the dire need for flexible technologies to meet these requirements, semiconductor MES takes center stage in the technology strategy of semiconductor manufacturers. It is focused on proactively enhancing processes, such as preventing quality problems. Semiconductor MES enables agile, interconnected workflows indispensable to today's semiconductor manufacturers.

Real-time information exchange supports collaboration and better decision-making across the extended enterprise.

Manufacturing Operations

With the COVID-19 crisis interrupting supply chains and increased geopolitical tensions, semiconductor companies are keen to accomplish end-to-end design and manufacturing capabilities. More than one trillion chips were manufactured worldwide in 2020 – about

130 chips for every person on earth.

But despite what their widespread presence might suggest, manufacturing a microchip is no mean feat. To remain competitive & efficient, chipmakers are automating their manufacturing operations, encompassing vertically integrating manufacturing systems and horizontally integrating IoT across the enterprise and semiconductor value chain.

Industry 4.0 tools, in this regard, substantially lower cycle times, improve productivity without expanding the fab footprint or adding capacity, increase automation, and decrease energy costs. Companies should utilize advanced analytics to reimagine time to yield and yield ramp-ups. Chipmakers can also collaborate with equipment manufacturers to apply advanced analytics and accelerate the yield learning curve.

For instance, modeling made possible by advanced combinatorial learning could replace the physical testing of chips and thus decrease the cost of introducing them and their time to market. Innovation in line with

Moore's law will certainly remain, but additional advances through system-on-a-chip architectures using 'chiplets' should also be explored.

Capitalizing on the immense opportunities,

Bosch has recently invested around one billion euros in the high-tech manufacturing facility, which, once completed, will be one of the most advanced wafer fabs in the world. During the start of the year 2021, Bosch began putting its first wafers through the fabrication process in Dresden.

The company plans to manufacture power semiconductors for DC-DC converters in electric and hybrid vehicles as the next step. These microchip prototypes can now be installed and tested in electronic components for the first time. With ambitious plans in place, Bosch is on the road to achieving many firsts in the semiconductor manufacturing space and leaving a successful trail.

Manufacturing Asset Operations

The semiconductor domain faces the rising complexity of manufacturing processes. It is characterized by high-cost pressure due to increasing competition and customer requirements in terms of quality. Therefore, it is essential to explore and establish optimization technologies that increase productivity to remain competitive.

Driven by emerging Industry 4.0 technologies, Predictive Maintenance (PdM) offers a possibility to improve productivity. The predictive maintenance technique leverages data analysis to detect problems in machine operations and fix them before failure. In other words, PdM optimizes machine utilization and therefore increases overall productivity.

To increase Return on Assets (ROA), leading organizations are implementing digital solutions for Asset Performance Management (APM). These solutions enhance Enterprise Asset Management (EAM) by capturing information and insights related to asset condition and performance to minimalize unplanned repair work, reduce equipment failure, enhance asset availability, and boost asset life without sustaining additional costs.

APM systems track & monitor asset performance and connect disparate sources of real-time & historical operational data to analyze and identify opportunities. This way, it helps improve asset performance, reduce maintenance costs and facilitate smarter decision-making in core business operations.

APM platforms possess data capture, data integration, data visualization, and advanced analytics capabilities to improve the reliability and availability of physical assets. They connect the production floor to a company's balance sheet using data related to the health and output of their assets. These advanced solutions forecast asset failure and enable predictive and proactive maintenance initiatives. They help the operations and reliability leadership understand how and when assets fail, allowing them to make changes and improve performance. Additionally, these systems leverage asset data from other enterprise software, including Automation & Control, ERP, EAM, MES, CMMS, and PLM systems.

Putting Strategy to Execution

An integrated enterprise business planning approach, supported by robust scenario modeling and predictive analysis, can improve planning accuracy and strengthen decision-making.

Click to zoom in

In a strategy called Copy Exact! Intel develops each semiconductor fabrication plant to the exact specifications, creating interchangeable processes and interchangeable fabs throughout the world. Copy Exact! began in the mid-1980s to cope with the incomprehensible complexity of semiconductor manufacturing. The minutest variation in temperature, pressure, chemistry, or handling can reveal the difference between the quality of the chip.

Once Intel succeeds in fixing the semiconductor manufacturing process at one facility, it copies that process to other Intel facilities, resulting in greater flexibility and operability. Intel can transfer capacity and work-in-process back and forth between facilities to remove manufacturing bottlenecks and defeat disruptions in any given facility. Copy Exact! Has already transformed Intel's global portfolio into a seamless virtual fab. Production of wafers can be modularized using this model without impacting yield. Today, this powerful strategy extends beyond semiconductor fabrication to the assembly and test factories and the contractors who support building PC motherboards and even beyond!

It's undeniable that the world is a different place after the COVID19 crisis, yet we do not know the extent of the changes that we are set to experience. With so much uncertainty in the offing, semiconductor companies should make the best use of opportunities by developing multiple future scenarios, each showing different macroeconomic and virus-related outcomes, as they plan their strategy for coming years.