Onboarding begins the moment a potential client gets connected with the marketing or sales team. The bank processes the request and initiates the KYC verification process by collecting relevant information and performing background checks to validate data.

Once the documentation and regulatory requirements are taken care of, the bank sets up an account and provides the access credentials to its clients.

Onboarding is an excellent opportunity for banks to provide an outstanding experience to their clients, cementing their loyalty. McKinsey reports that banks can increase their profits by 40%, provided they introduce digitization in their onboarding processes. However, traditional banks are yet to catch up with this trend, resulting in arduous, time-consuming, and costly onboarding processes.

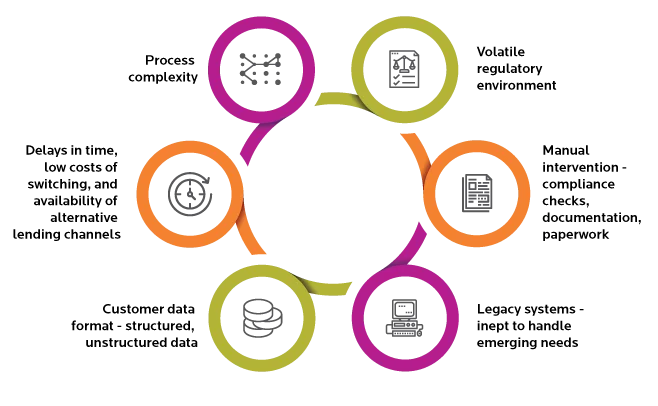

Let’s explore some top challenges that make the traditional client onboarding experience in banks so onerous.

Challenges with the Traditional Client Onboarding Process in Banking

The complexity of the process with multiple cross-functional teams involved

A typical client onboarding process in the financial services industry involves multiple cross-functional teams (sales, marketing, legal, operations, strategy, and technology):

- Sales and marketing teams handle client acquisition

- The front office processes onboarding requests

- The KYC team processes client documentation and performs regulatory due diligence while the credit team undertakes the credit risk assessment

- The back-office operations team undertakes account setup

Because of the sheer number of stakeholders involved, there’s a lack of ownership of the onboarding process. These diverse teams don’t collaborate efficiently to provide a seamless and frictionless customer experience.

Delays in time, low costs of switching, and availability of alternative lending channels

According to McKinsey, the entire customer onboarding process from the initial consultation to the final go-live (i.e., when the account is active) takes anywhere between 43-64 days (or more).

Banks spend 50-75% of the costs associated with the onboarding process on approvals — KYC, credit checks, legal agreement, and the back and forth between the various teams involved. As a result, the relationship between banks and clients isn’t off to an impressive start.

As a result, clients have no qualms about switching banks when presented with the prospect of an alternative channel that puts the customer at the center. A growing number of fintech startups, neobanks, and e-commerce platforms have cast their hats into the ring. Unlike traditional banks, these businesses are skilled at enhancing customer experience and hold the gold standard for customer satisfaction. Loan originations continue to get hampered because of these challenges, and digital does offer a way out – read more here on this topic.

Customer data format – structured, unstructured data

Since several banks rely on manual processes and paperwork to perform for KYC, the data collected is in different formats - a mix of structured, semi-structured, and unstructured data. Extracting value from such messy and disorganized data is an extremely cumbersome task. Additionally, if the bank doesn’t maintain a central repository of all client-related data (without inconsistencies), one can’t rely on such data to extract strategic insights.

With several departments handling different aspects of the onboarding process, a sizeable portion of client data lives in silos. In several cases, information is missing, duplicated, or conflicting because of a lack of standardization and homogenization.

Legacy systems - inept to handle emerging needs

As mentioned earlier, banks capture client data in various formats from a plethora of distinct sources. Legacy systems supporting back-office operations aren’t capable of efficiently and effectively processing and organizing such data. This leads to expensive and complicated customizations and significantly reduces the speed at which banks acquire new clients.