How systems modernization using SAP S4/HANA and process overhaul revved up decision-making, growth, and agility for a top global re-insurer

The Challenge

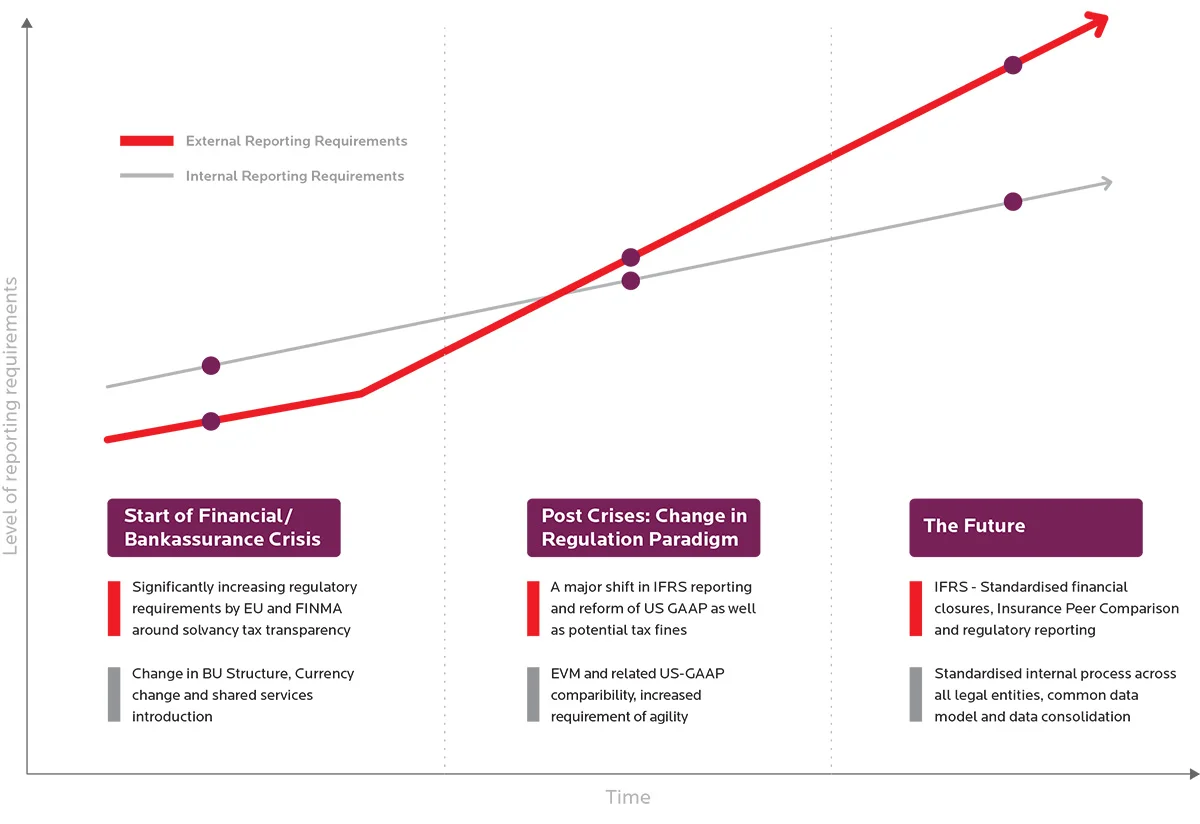

The insurance industry is undergoing a significant transformation due to the pandemic, the bancassurance crisis, and the growing scrutiny of technical debt by regulators. These factors have created a new market that demands more radical changes in the operating models of insurers. The full impact of these changes may not be evident until 2025 or later. Still, some core challenges are emerging, such as the rise of ecosystems and the evolving ledger regulatory requirements for solvency and taxation transparency. One of the fundamental regulatory changes is the introduction of IFRS 17 on May 18, 2017, which requires insurers and reinsurers to adopt a new reporting standard by January 1, 2023, with retrospective opening balances. Many stakeholders expect that IFRS 17 will enhance transparency by using consistent current estimates and providing more insights into insurers' profit generation, asset composition, and liability structure. Re-insurance organizations face the challenge of keeping up with the dynamic global regulatory reporting landscape and meeting organizational needs while reducing the risk exposure from non-compliance and becoming trusted advisors to their businesses.

Figure 1 – The evolution of regulatory reporting requirements

Birlasoft team helps organizations by bringing in standardization to reduce complexity and financial reconciliation cycle time up to 90%, thus helping insurers transform their finance functions into active leaders and value creators for the entire business. Our leading-edge finance transformation methodology allows clients to stay on top of industry trends and build an agile, efficient, transparent, and risk-averse organization while maintaining regulatory compliance. Adopting SAP FPSL as the sub-ledger solution for IFRS 17 accounting is the most optimized sub-ledger solution for insurers in the market. Our expertise in FPSL architecture and IFRS 17, combined with our experience in integrating SL and GL, has helped our clients operate with harmonized multi-valuation charts of accounts.

How Birlasoft is helping insurers in achieving this paradigm shift!

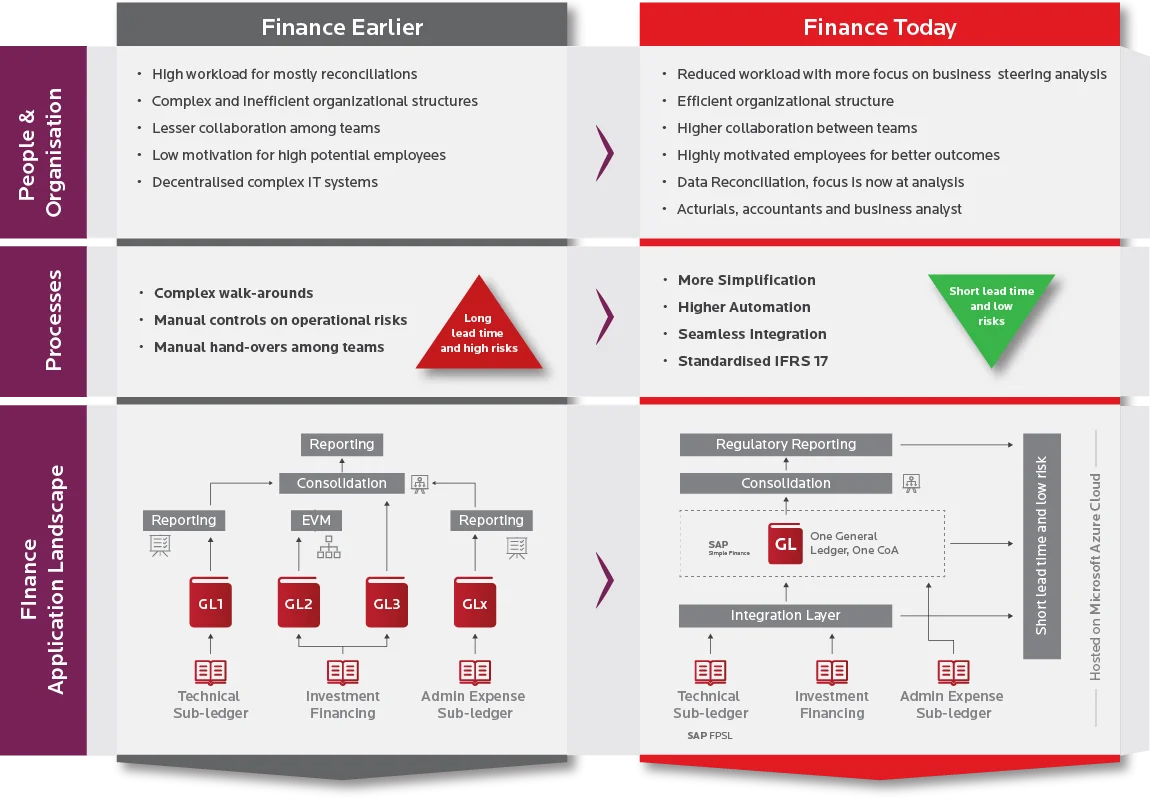

The shift from IFRS 4 to IFRS 17 is moving insurers closer to other industries regarding the comparability of their financial statements. We have helped the organizations build a resilient and steering balance sheet and transform their financial management functions based on below four pillars:

- Standardized processes

- Robust reporting

- Timely delivery of financial information

- Best and Latest technology with the right partner

Four mission-critical priorities to the success of this transformation program:

- Reducing the lead times of various processes and closures in their finance ecosystem was crucial to its mission.

- Modernizing its historically grown legacy systems into a simplified and integrated setup with a high degree of automation, data analytics, and process control enables swift closures supporting a cultural shift towards data-driven decision-making.

- Bringing an end to the ineffective collaboration between multiple teams for financial reconciliation.

- Choosing the latest and best technology with the right partner who can help manage the vast data load and efficiently upgrade actuarial models, accounting rules and calculation engines, data warehouses, and reporting tools.

Figure 2 – Three priorities clearly emerged out as mission-critical to the success of this transformation program

How Birlasoft Can Help You

Simplify and standardize reconciliation to build efficiency, transparency, and reliability.

As part of the operation model review, our client identified the need to switch to operating on a single standard, one integrated sub-ledger, and a general ledger to drive simplification and standardization of processes.

To support this objective, our team of experts built an integrated one general ledger and one chart of accounts built on the SAP S/4HANA platform that served as the interface between consolidation exercise and the information flowing in from multiple sub-ledgers using a newly built S/4HANA sub-ledger solution. It provided a single source of financial data and a harmonized multi-valuation chart of accounts.

Accelerate and reduce process cycle times by removing obsolete steps from the reconciliation cycle.

Our team collaborated with the client to reduce the redundancies and obsolete steps in the account reconciliation process. We worked with the team to build an agile methodology-based framework, refined their target operating model, and laid the foundation for future product development and change management. We leveraged the cloud to bring in scale, streamline their process, and counter pervasive redundancies across their operations.

Build financial information transparency and drive faster and more accurate decision-making at-scale

We worked with the client to improve the availability and management of financial data, eliminate effort-intensive reconciliation, and reduce critical personnel dependency. To minimize the number of exchanges between a sub-ledger with multiple ledgers, we built an integration layer that served as the intermediary between one general ledger and various sub-ledgers. Instead of fleshing out numerous reports and then consolidating them, everyone now had access to one consolidated monthly report on the cloud (SAP S/4HANA) to drive agility at scale and cost optimization. In addition, the new sub-ledger system we implemented will increase transparency and make accounting processes faster, thereby achieving optimization and accurate data at scale. This program transformed these aspects of their financial management process - cost transparency, general and sub-ledger, reporting, lease accounting, controlling, and intragroup retro acceleration.

Figure 3 – Our three-pronged approach to driving financial business transformation

Highlights

- Reduction in financial reconciliation cycle time for the client and creation of a single, standard, and integrated general ledger for all results in a standardized and integrated finance platform, which is highly efficient and supports compliance needs. The switch to one consolidated MIS has massively improved the consistency and timeliness of generating management reports. Checks and balances are now in place to ensure the reliable production of financial information and auditability of all financial statements and valuations.

- Our Simplified Solution for IFRS 17 is a managed service that accelerates insurers’ and reinsurers' IFRS 17 projects, de-risks implementation and developments, and ongoing reporting with minimal changes to current systems. We have combined actuarial, accounting, IT, and data analytics specialists to implement a cloud-based solution in a production-sized, controlled environment. You give us your input data; we provide you with the IFRS 17 files and reports you need for your financial statements and disclosures.

- Our clients now comply with IFRS, US GAAP, STAT, and EVM, making their balance sheet more resilient and steering through multi-valuation. From mere SOX and GAAP to this level of compliance has been nothing short of transformational. While supporting this global reinsurer on the first milestone of its transformation journey, as you read this, our team of experts is now helping the organization achieve the second milestone – more on that in times to come.