Four ways to deliver great customer experience in the age of digital insurance

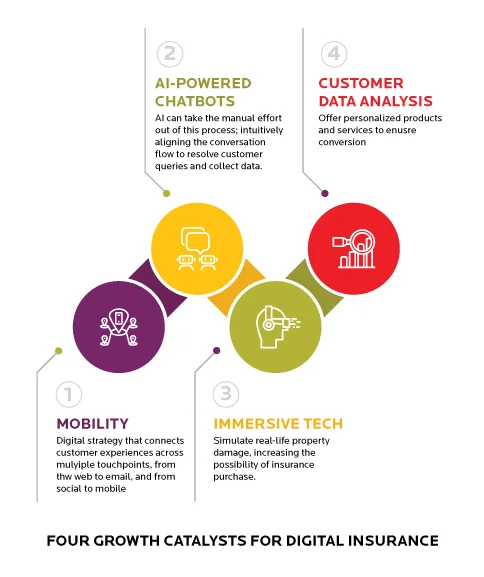

The BFSI sector – specifically insurance – has been known for its sub-optimal quality of customer experience (CX). However, insurers rated as leaders in terms of CX witness premium growth at a 2X faster rate. How can insurance companies leverage technology to bridge the CX gap? We discuss critical opportunities in four areas (mobile, artificial intelligence, AR/VR, and data analytics).

Customer experience is now among the most significant differentiators across industry sectors. This is particularly true for insurance, with product penetration so high and product innovation being extremely difficult to achieve. The latest tech can help carriers stand out, but the quality of experience delivered at the moment is far from impressive.

The State of CX in Insurance Indicates Several Areas of Improvement

BFSI was traditionally known for its poor quality of experience. Adobe found that 48% of BFSI companies are aware of the sub-par state of their CX. In insurance, companies face several complexities like personalization and integration. 88% of insurance customers want highly personalized offerings. They are also eager to embrace integrated products (e. g. home, life, and car insurance with a single premium), indicating the importance of seamless experiences. Meanwhile, most carriers operate out of a fragmented network of touchpoints spanning digital and brick-and-mortar.

Health insurance was ranked the lowest in terms of CX, out of 19 categories, in a 2019 report by Forrester – automotive, home, and life follow close behind. This fact isn’t a surprise, given that only 1-10% of a typical insurer’s customer communications are about the services they provide, with an overwhelming 90-99% bent on sales. Insurers need to rethink their strategic stance from a CX vantage point. Here’s where cutting-edge technology can help.

Four Tech Tools that Could Revolutionize Insurer’s CX Capabilities

Globally, insurers’ investment in technology is skyrocketing, expected to grow at 16% CAGR by 2023. This investment needs to be intelligently applied to CX transformation, unlocking significant improvement to the topline. Here are four next-gen technologies that could prove game-changing for insurers.

- Deploy a mobile-first brand footprint

Customers already spend 40% of their research time on mobile devices before choosing an insurance product. 5% of customers will use only their smartphone for insurance purchases

These trends indicate why it is so critical for carriers to strengthen their mobile capabilities. It isn’t enough to have a mobile app where your customers can track their premiums and make transactions. Carriers need an end-to-end digital strategy that connects customer experiences across multiple touchpoints, from the web to email, and from social to mobile.

- Leverage Artificial Intelligence (AI)-powered chatbots

It’s interesting to note that insurers spend an average of $124 million per company on AI. This high investment is because of its multi-faceted capabilities – it can optimize risk modeling, automate claims submission, and of course, streamline customer communications.

AI powered chatbots are an excellent way to engage low intent prospects and gently convert them across the funnel. Today, 51% of companies are looking to offer live chat with customer care representatives. AI can take the manual effort out of this process; intuitively aligning the conversation flow to resolve customer queries and collect data.

There are already a few early movers in this space like Singapore Life’s bot for Facebook Messenger that guides customers through the life insurance coverage process.

- Apply Augmented Reality/Virtual Reality (AR/VR) to negotiate customer expectations

Among the most promising technologies for CX, AR/VR is at a relatively early stage of maturity. For several years, large form factor and the lack of low latency networks held back AR/VR at scale. But today, design breakthroughs combined with the rollout of 5G are making AR/VR experiences more viable.

And this could have a significant impact on insurance. Carriers could use AR/VR to simulate real-life property damage, increasing the possibility of insurance purchase. Existing customers could be trained via AR/VR – for example, yoga training for medical policyholders to bring down the number of claims in the long-term. It could even play a part in claims approval, with customers projecting a scene through a VR headset so that the carrier can take a quick decision without being present in person.

- Unlock upselling/cross-selling insights from customer data analytics

Given that personalization is a top demand for insurance customers, it makes sense to offer personalized products and services to ensure conversion. 42% of consumers would buy a customized financial package that suits a specific life event.

But to make this happen, carriers need advanced data analytics that reveals actionable insights. A simple example would be to monitor customer communication for instances of a new home purchase and push a home insurance policy via digital channels at the right moment. This data-to-insight-to-action shift is the reason why 56% of BFSI companies are planning to leverage data insights for customer segmentation.

What Are the Benefits of Reimagining CX?

In the digital era, insurers cannot afford to ignore the quality of their customer experiences. 85% of customers say that they are unlikely to do business with a company after a bad mobile experience. And 7 out of 10 would leave a website that wasn’t mobile-optimized. With so many channels in play, carriers must provide a seamless, engaging experience across touchpoints without disturbing the flow of communication. The payoff for companies that achieve this is also very high. “Companies that offer consistently best-in-class CX grow faster and more profitably,” found McKinsey. CX leaders boast a 16% uptick in annual premium growth, versus only 3% among laggards.

The writing is on the wall. It is vital to use cutting-edge technologies like mobile, AI, AR/VR, and data analytics to deliver the best possible experiences. This shift towards digital will help to bolster and retain margins in today’s highly competitive market landscape.