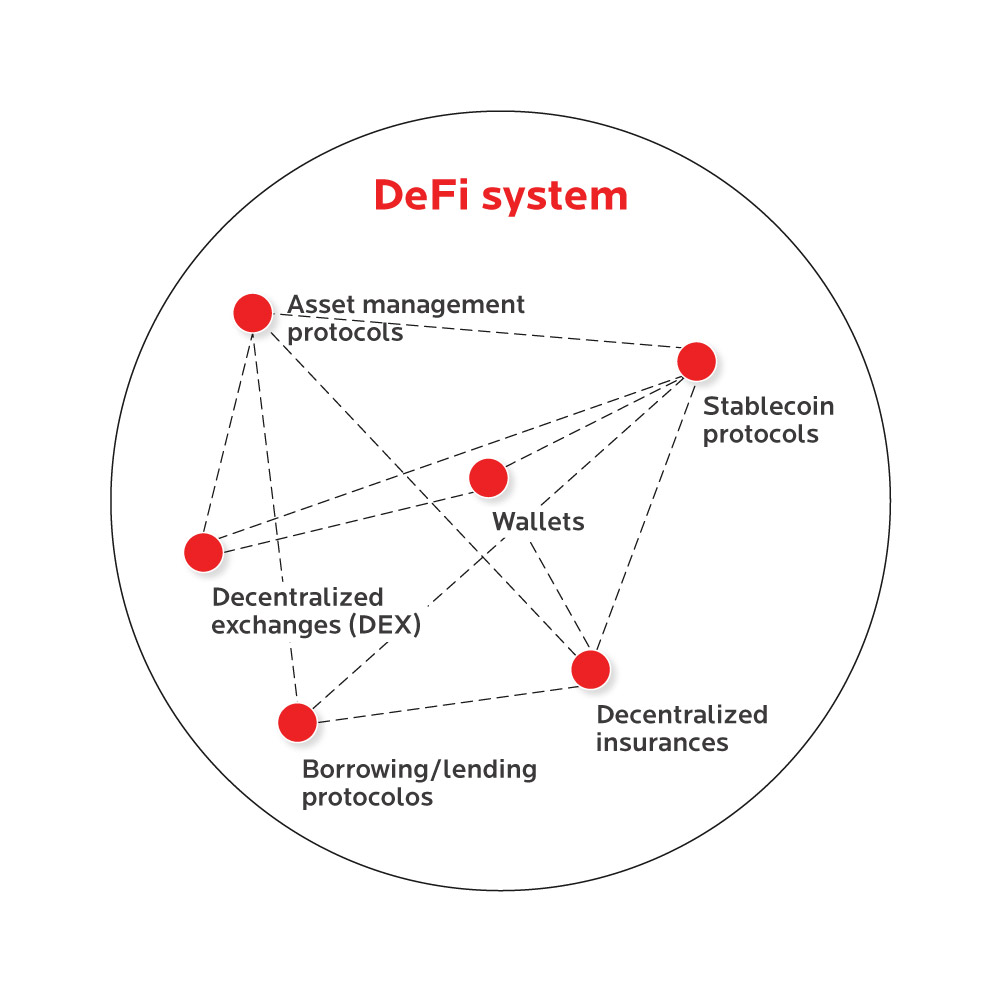

The breakthrough of DeFi is that digital assets can now be used in ways not possible with traditional or fiat assets. From lending and borrowing platforms to InsurTech and tokenization, the DeFi has paved the way for an expansive network of integrated protocols and financial instruments. This paradigm shift in financial infrastructure presents several improvements concerning risk management, security, and business opportunities. In its current state, DeFi is mainly used for crypto asset management and trading. However, as the ecosystem continues to grow and expand, DeFi is increasingly being used for financial services, including lending, borrowing, DEXs, investing, and insurance.

DeFi Vs Traditional Finance

Traditional financial systems rely on the authority and control of centralized infrastructures and intermediaries, such as banks and financial institutions. The users in this system are subject to the rules and policies made by these organizations and must trust that they will act in their best interests. However, the recent incidents of multiple banks failing in the United States led to concerns about the stability of the current banking system. The collapse in bank asset values has increased the fragility of the U.S. banking system.

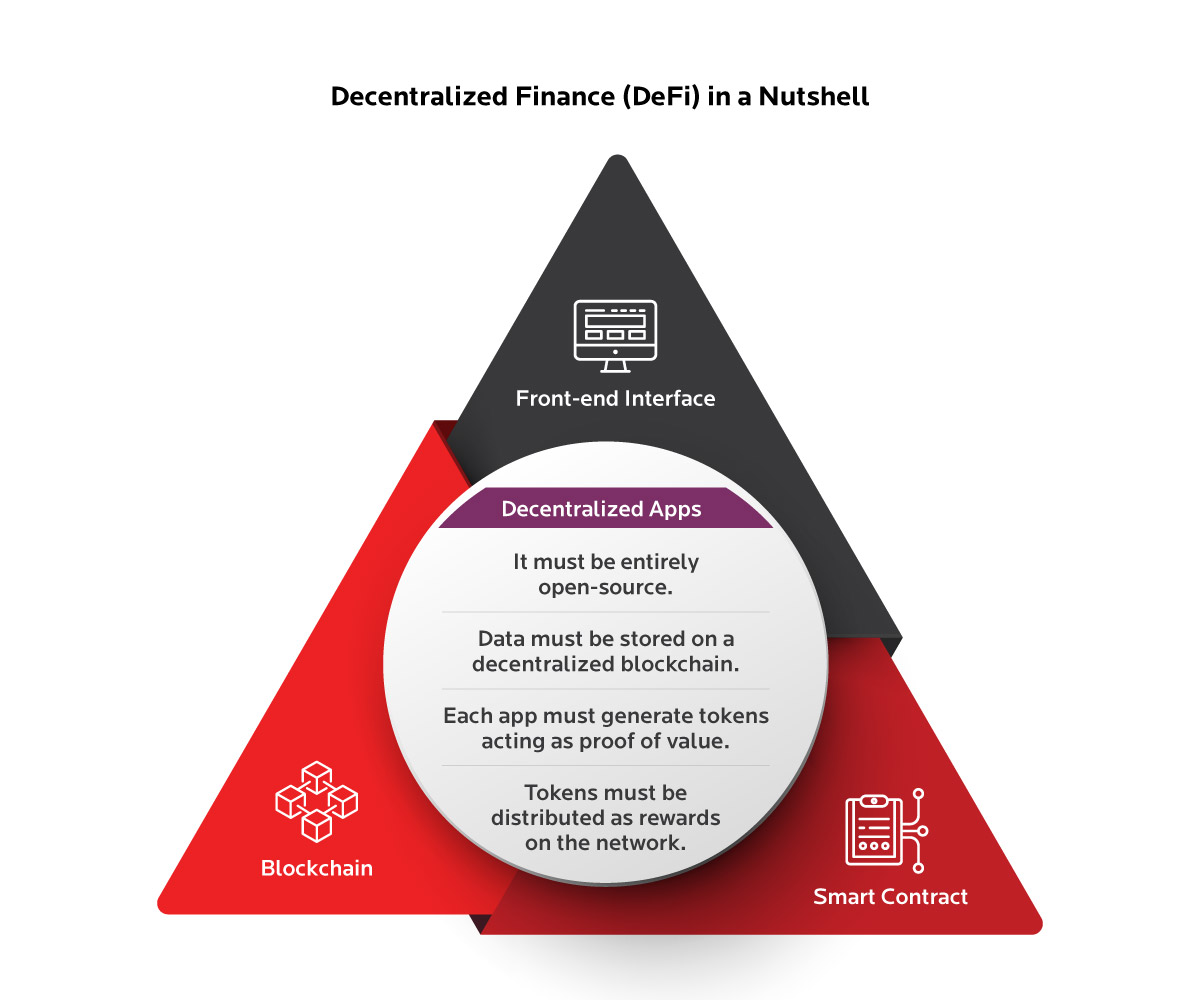

The reports predict that bank failures will rise this year, with total deposits in banks that fail during the current crisis. This scenario could invite more people to turn to DeFi platforms as an alternative to traditional banking. DeFi relies on distributed networks built on blockchain technology, enabling trustless transactions without requiring a centralized party or intermediary. It allows users to access financial services with reduced costs, counterparty risk, and faster transaction times. DeFi offers more control over the funds by enabling the users to interact directly with the contract code powering the protocol.

DeFi Fitment in the Existing Financial Model

Traditional financial models have existed for centuries and have a proven track record of providing essential financial services. However, these models can be slow, expensive, and inaccessible for unbanked populations. DeFi can offer a more open, transparent, and accessible financial system and improve the efficiency and security of financial transactions by eliminating intermediaries and leveraging blockchain technology. Although DeFi challenges traditional finance models, it is a complementary fit to the existing infrastructure. A hybrid approach combining the strengths of traditional financial models with the benefits of DeFi can be the most effective way to offer new financial products and services. From banking and insurance to lending and asset management, DeFi can be used to create novel services that are more accessible, cost-effective, and secure than traditional financial services. The key fittings include:

Banking:

DeFi protocols can create decentralized banks that are not subject to the same regulatory constraints as traditional banks. These banks can offer novel services such as interest-bearing accounts and peer-to-peer lending. Moreover, blockchain technology can enable financial services without central servers or custodians.

Insurance:

Decentralized insurance protocols (such as Nexus Mutual) can help insurance companies to allow individuals to pool resources and share risk in a completely transparent and trustless manner. It could lead to cheaper and more accessible insurance products for consumers.

Lending:

DeFi protocols can also be used to create decentralized lending platforms. This can allow borrowers to get loans directly from lenders without going through a traditional bank or other intermediaries, leading to lower borrowing costs and faster loan processing times.

Real Estate:

DeFi can enable fractional ownership in real estate, allowing property owners to sell fractions of their properties and enabling investors to invest in fractional real estate assets. It can streamline the entire real estate transaction process using smart contracts through the agreement terms between buyer and seller, reducing the time and cost involved in the transaction process. DeFi can also automate rent based on inflation, occupancy rate, and other variables, which can benefit landlords and tenants.

Supply chain:

DeFi can automate the execution of contracts and payments, provide access to trade finance, enable tokenized assets, and reduce the cost of financing. Additionally, it can increase transparency and traceability in the supply chain through blockchain, which provides an immutable record of transactions, mitigating the risk of fraud and delays. DeFi has the potential to streamline the supply chain industry, reduce costs, and provide access to financing for small and medium-sized enterprises (SMEs).

Asset Management:

DeFi technology can be used to create decentralized asset management platforms that enable individuals to invest in a wide range of assets (such as stocks, bonds, and cryptocurrencies) without going through an expensive intermediary. It could reduce investment costs and make investment more accessible for retail investors.

Challenges of DeFi

While DeFi has the potential to revolutionize the traditional financial system through plenty of opportunities, a few key challenges surrounding the ecosystem must be addressed. These include:

Over collateralized loans:

Due to the rise of anonymous borrowers, over-collateralization is prevalent in the DeFi ecosystem. The resulting procyclicality with over-collateralized lending can lead to capital inefficiencies, maturity vulnerabilities, and liquidity issues.

Regulatory Uncertainty:

The regulatory landscape for DeFi is currently unclear. While some countries have taken a hands-off approach, others have issued warnings or imposed restrictions. This has created a challenging environment for DeFi developers and users, who must navigate a complex and uncertain regulatory landscape.

Interoperability:

The presence of multiple blockchains powering different applications leads to a lack of interoperability among users that want to transfer their assets to new systems. Moreover, DeFi protocols are often siloed with each other limiting their ability to provide a seamless user experience.