From B2B to B2B2C: Why are the next-gen manufacturers bullish about this shift?

As manufacturers rapidly move towards an omnichannel world, the traditional lines between B2B and B2C are getting blurred. And this has impacted nearly every industry, starting from insurance and retail, and now manufacturing. Both B2B and B2C players must relook at their marketing value chain from a fresh perspective, as the modern consumer refuses to come under such rigid labels.

The popularity of B2B2C has a lot to do with the rise of omnichannel access, opening up product catalogs, and purchase possibilities for every segment. Let's take a simple example, an FMCG product such as cosmetics can be sold via retail outlets or directly on the manufacturer's website. The manufacturer, therefore, must be ready to cater to business buyers and end-consumers alike. This mandate requires robust supply chains, next-gen omnichannel capabilities, and differentiated customer experience.

Recent Trends in the B2B2C Space

Business to Business or B2B refers to scenarios where manufacturers would sell components/products that play a direct role in the buyer's business. For example, Boeing is an aircraft manufacturer that deals with a variety of carriers around the world. Business to Customer or B2C, on the other hand, involves product sales to a single end-consumer, not intended for commercial usage. A private aircraft seller marketing to high-net-worth individuals has the same product as Boeing but approaches it from a B2C perspective.

But thanks to omnichannel commerce, these distinctions no longer apply. For instance, a commercial airline carrier might reach out to a private seller in search of a specific part or maintenance service. Similarly, in theory, an individual buyer could strike a deal with Boeing -- this change in mindset has an incredible impact on the manufacturing sector, changing how enterprises view and market their products.

In 2018, following a period of high sales growth, Salesforce CEO Mark Benioff commented on the importance of B2B2C: "We see every B2B company and every B2C company becoming a B2B2C company. I see that over and over again." in a recent survey, Forrester found that B2B2C is the preferred business model for 21% of companies, including materials manufacturing, construction, utilities, and CPG, among others. The report highlighted the criticality of forging strategic partnerships -- for 76%, partnerships are central to sales and marketing and a key to earning revenues.

Partnerships with e-commerce vendors, technology providers, local suppliers, and marketing intermediaries are vital to succeeding in the B2B2C landscape.

Examples of B2B2C in Manufacturing

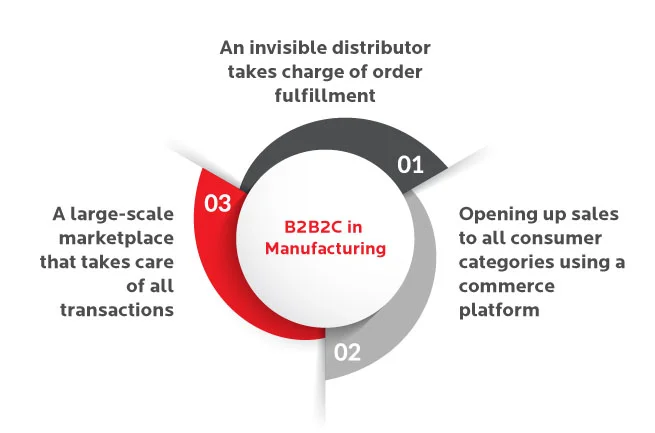

At its core, B2B2C urges manufacturers to be cognizant of the end-consumers needs and not just cater to the business buyer. The following three examples illustrate this:

- An invisible distributor takes charge of order fulfillment - Here, the manufacturer appears to be selling directly to the end-consumer, but outsources the order fulfillment stage to a distributor. Branding, marketing, etc. is still the onus of the manufacturer -- the invisible distributor takes charge of logistics, without purchasing the inventory.

- Opening up sales to all consumer categories using a commerce platform - This is the most common example of B2B2C in manufacturing. Distributors, direct sales reps, and the end-buyers all use a unique omnichannel commerce platform like Salesforce for transactions. This approach increases revenue generation, as manufacturers can offload their inventory through several different channels.

- A large-scale marketplace that takes care of all transactions - Manufacturers can tie up with digital marketplace giants such as Amazon and Alibaba. In this example, manufacturers have the least amount of control, but they also shoulder a very low-risk level. Inventory management becomes a risk for either the distributor or directly the marketplace. And, every sale takes place through these online outlets.

B2B2C isn't an out-of-the-box technology that can override existing approaches. It requires a careful rethink of supply chain structures and partnerships, with an eye on reaching the maximum number of customers. Manufacturers eager to embrace B2B2C could face a few challenges:

Challenges to an Effective B2B2C Pivot

The selection of the delivery channel can pose a problem, as most manufacturers are unfamiliar with B2C purchasing platforms. Also, customers expect a smooth and seamless buying experience, regardless of who the seller is. An experience of this nature requires a high degree of expertise in terms of experience design, customer support, and fulfillment speed. As a result, manufacturers might need to change their upstream and downstream supply chain structures dramatically, prioritizing hyper-localized service providers over other parameters.

Finally, B2B2C marketing models can be complicated. Enterprises need detailed insights into the end-customer, studying their purchase behavior and intent triggers. Over time, manufacturers will be able to establish themselves as a trusted seller to every buyer segment by leveraging advanced customer insights.

What is the Way Forward for Manufacturers?

Despite these teething challenges, it is impossible to ignore the benefits of B2B2C. There is an apparent demand from distributors and consumers who are acutely familiar with omnichannel models. Also, it personalizes the buying experience, establishing the enterprise as a "preferred brand" independent of the distributor. And, of course, it enables massive additions to the bottom line, by reducing commission payments and operating costs, while gaining from the market price of products. To take advantage of the B2B2C trend, manufacturers need next-gen technologies like Configure Price Quote (CPQ) systems, next-gen commerce clouds, like Salesforce and deeper insights into customer sentiment.

B2B2C was named as one of the key trends to look out for in the US Manufacturing Industry Outlook for 2019. With an intelligent roadmap for tech-transformation, partnership network rewiring, and marketing overhaul, manufacturers can overcome the challenges we cited to become an early adopter, leaving behind the competition.